Vista’s article titles ‘Cashless society thwarted by economic uncertainty’, data suggests features in insider.co.uk (1 Nov 2022):

More than 23m people in the UK used virtually no cash last year, resulting in cash payments being forecast to drop to 6% within a decade, according to an article published by The Guardian.

Though there were fears of millions of cash-only consumers being left behind, contrary to this, the Post Office reported handling a record-breaking amount of cash in August, indicating that cash is making a comeback as a result of the cost of living crisis.

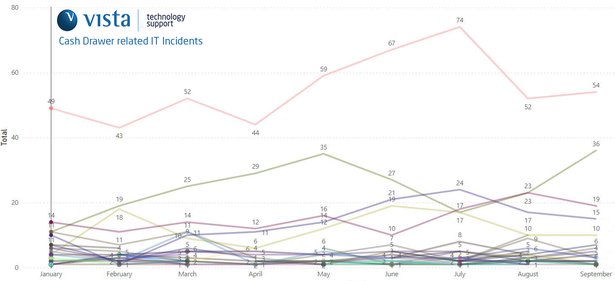

This is further substantiated by findings made by Vista Technology support, which has seen an increase of 72% in cash drawer related IT incidents raised by retailers in the last few months.

Cash comeback driven by economic uncertainty

The use of cash was in gradual decline prior to the pandemic when cash was overtaken by card payments back in 2017, a year earlier than expected.

But when there’s economic uncertainty and high inflation like now, people turn to cash.

Natalie Ceeney, chair of the Independent Access to Cash Review, said there was evidence that cash use had increased for the first time in several years as the cost of living crisis worsened and people returned to the safety of notes and coins to help them budget.

This is further reinforced by the Post Office’s most recent report which reveals it handling record-breaking amounts of cash in August (£3.45b), reflecting: “As the cost of living begins to bite, people are also increasingly turning to cash to manage their budget on a week-by-week basis and often day-by-day.”

Increase of 72% in cash drawers incidents

Cash drawer related IT incidents from Vista Technology Support

Cash drawer related IT incidents from Vista Technology SupportVista Technology Support manages tens of thousands of IT incidents every month and can spot emerging trends in technology failures. In July 2022, its data analysts identified a significant increase in IT incidents relating to cash drawers which has remained consistently high ever since.

Vista’s CEO, James Pepper commented: “When footfall or transactions increase or decrease, our data analytics systems and colleagues often identify the change first, sometimes even before our customers have noticed a change.”

This recent trend could be linked to the reinstating of cash drawers that had been decommissioned during the pandemic, when people turned to contactless to minimise contact through cash, alongside the current crisis.

With cash payments forecast to drop to 6% within a decade, whether the current sudden cash comeback will significantly thwart us moving towards a ‘cashless society’, is still to be seen.

Vista Technology Support

Vista, retail and hospitality technology services provider, supports more than 250,000 points of sale, self-service and IT systems. This includes back-office technology, warehouse and dark store technology and shop floor technology.

If your technology is deployed within a store environment, Vista can provide both preventative and responsive maintenance and support through its IT helpdesk and ‘break-fix’ services.

Visit vistasupport.com, email sales@vistasupport.com or call 0345 070 0393 to obtain expert advice

To view the original article as it appears online on insider.co.uk, click HERE.